No.80 Changjiang Mingzhu Road, Houcheng Street, Zhangjiagang City, Jiangsu Province, China +86-15995540423 [email protected] +86 15995540423

Carbon fiber industry winds up in 2024, the market size and production to achieve growth, however, the gross margin of enterprises fell slightly. The capital market carbon fiber industry investment and financing is more active, a number of investment and financing events. Looking forward to 2025, the carbon fiber market will rebound.

I. China carbon fiber industry market review in 2024

(I) Market Status

1. Market size growth

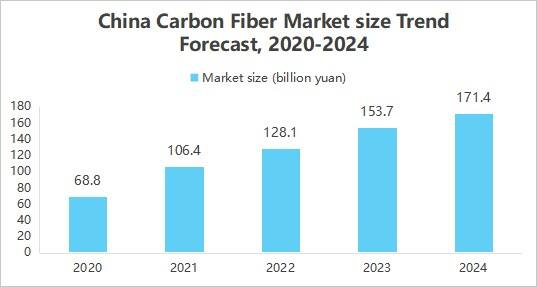

Carbon fiber has been expanding its application in aerospace, automotive, wind power and other fields due to its excellent properties such as high strength, low density, corrosion resistance, etc. At the same time, technological advancement has driven down the cost, and policy support and other factors have worked together to promote the expansion of the market size of the carbon fiber industry. China Carbon Fiber Industry Market Survey and Investment Prospect Research Report 2025-2030” released by China Business Industry Research Institute shows that China's carbon fiber market size is about 17.14 billion yuan in 2024.

2. Industry capacity enhancement and centralized distribution

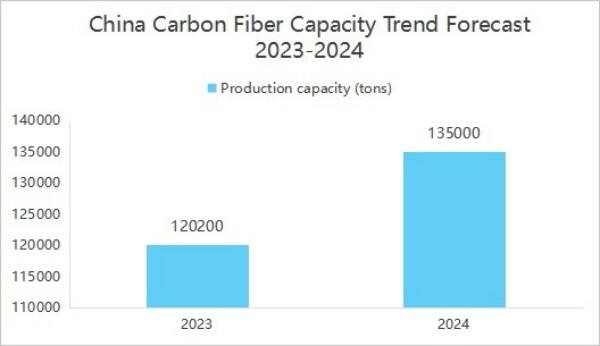

The production capacity of China's carbon fiber enterprises has been improving. China Business Industry Research Institute released the “2025-2030 China carbon fiber industry market survey and investment outlook research report” shows that as of the end of 2024, the annual production capacity of domestic carbon fiber reached 135,500 tons.

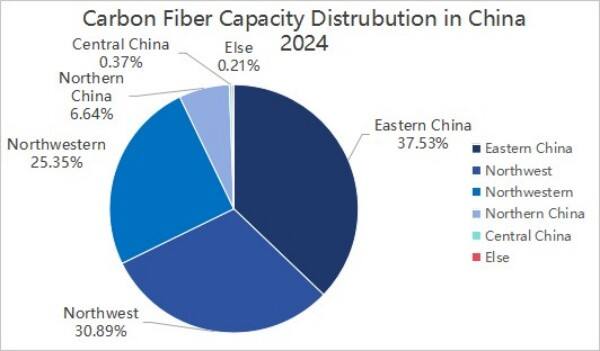

In the distribution of production capacity, in 2024, China's carbon fiber production capacity is concentrated in three regions by the East China, Northeast and Northwest, the three together accounted for 92.77%.

3. Product model concentration

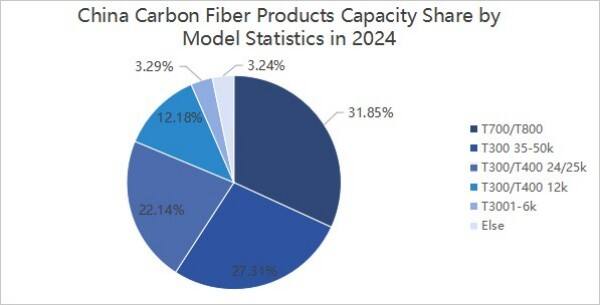

Sub-type view, in 2024 China's carbon fiber production to T300, T700 and T800 level. Among them, the production capacity of T300/T400 level carbon fiber is about 87,960 tons, accounting for about 64.92%; the production capacity of T700/T800 level carbon fiber is about 43,150 tons, accounting for about 31.85%; the production capacity of other types of carbon fiber is about 4,390 tons, accounting for about 3.24%.

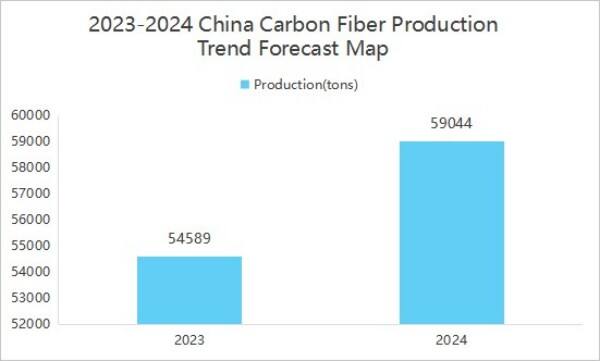

4. Production growth

The output increases with the increase of market demand. China Carbon Fiber Industry Market Survey and Investment Prospect Research Report 2025-2030” released by China Business Industry Research Institute shows that China's carbon fiber production was 59,044 tons in 2024, an increase of 8.16% year-on-year.

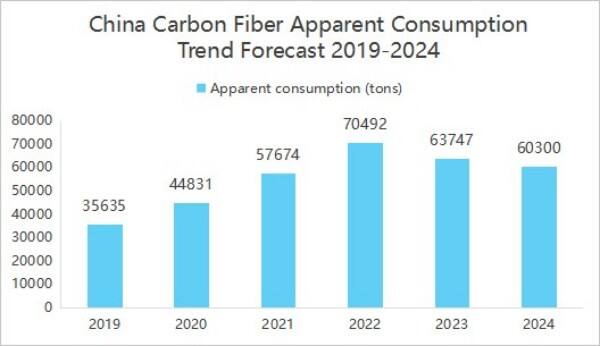

5. Apparent consumption decreased year-on-year

In 2024, China's carbon fiber products exported about 15,172 tons, a large number of products exported to make the apparent consumption of the domestic market is relatively reduced, giving people the illusion of declining domestic demand, but in fact part of the product is flowing to the international market. The “2025-2030 China Carbon Fiber Industry Market Survey and Investment Prospect Research Report” released by China Business Industry Research Institute shows that the apparent consumption of the domestic carbon fiber industry in 2024 was 60,300 tons, a year-on-year decline of 5.41%.

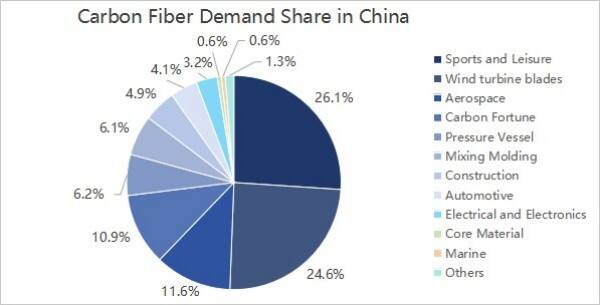

6. Downstream demand mainly comes from the fields of sports and leisure and wind turbine blades

From the perspective of downstream demand, the downstream demand of China's carbon fiber industry has not changed much, mainly from the fields of sports and leisure, wind turbine blades, aerospace and military and carbon and carbon fiber, which account for 26.1%, 24.6%, 11.6% and 10.9% respectively.

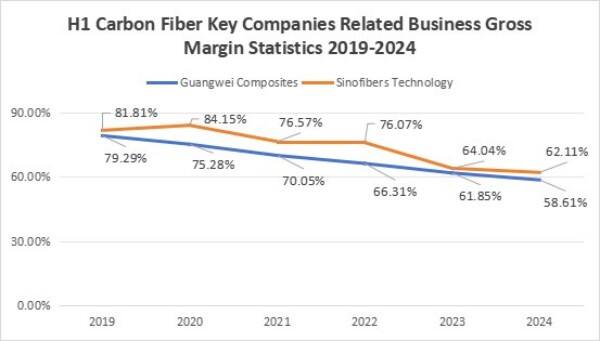

7. Gross profit margin of enterprises has declined

The gross profit rate of enterprises showed a decreasing trend, in the first half of 2024, the gross profit rate of GuangWei compound related business is 58.61%, and the gross profit rate of ZhongJian science and technology related business is 62.11%. Carbon fiber pre-prices hot market attracted a large amount of capital and enterprise influx, production capacity has expanded significantly. 2023 China's carbon fiber operating capacity of 140,800 tons, an increase of 25.7% over the previous year, but the demand side of the slow growth or even a decline, product supply exceeds demand, prices fell. At the same time, the enterprise raw material price fluctuations, there have been due to inflationary pressures acrylonitrile price increases, resulting in carbon fiber raw silk production costs, in the case of falling product prices or a smaller increase in the cost of the rise led to a decline in corporate gross margins.

(Ⅱ) Competitive landscape

The competitive landscape of the carbon fiber industry is mainly divided into three echelons.

The first echelon includes Jilin Chemical Fiber and Zhongfu Shenying;

The second echelon includes Xinchuang Carbon Valley, Xinjiang Longmu, Guangwei Compound Material, Shanghai Petrochemical and Baoging Carbon Material;

The third echelon includes enterprises such as Zhongjian Technology and Changsheng Technology.

(III) Investment

In 2024, there were 17 investment and financing events in the carbon fiber industry, with investment and financing amount of 1.999 billion yuan. on August 29, 2024, Xinwanxing Carbon Fiber raised 1 billion yuan in Series B financing, pulling up the investment and financing amount of the industry.

From the point of view of investment and financing events, carbon fiber industry investors include Shandong Caijin Group, Sany Heavy Energy and other industrial capital, but also Sequoia China, Zhenge Fund, China Science and Technology Innovation Star and other professional investment institutions, as well as Shaoxing State-owned capital, Wutongtree Capital and other state-owned background investors, diversified investment body for carbon fiber enterprises to bring not only capital, but also industrial resources, technical support, policy guidance and other aspects of the advantages.

II. China's carbon fiber industry forecast in 2025

(I) Development prospects

1. Industrial policy landing, more industrial support policies

The Chinese government's support for the carbon fiber industry has been increasing, and a series of policy documents have been issued to clarify the development goals of high-performance carbon fibers and other key strategic materials. These policies not only provide financial support and tax incentives, but also vigorously promote industry-university-research cooperation and talent training. The continuous force of the policy will strongly accelerate the research and development process of carbon fiber technology, expand its application areas, and promote the carbon fiber industry to a higher level of development.

2. Technological innovation to promote performance improvement

With the continuous increase of scientific research investment and technological breakthroughs, the performance of Chinese carbon fiber is expected to be further improved. For example, by improving the production process and optimizing the formulation of raw materials, the strength and modulus of carbon fiber can be improved, while reducing production costs. In addition, new carbon fiber, such as with high temperature, corrosion resistance, high strength and other special properties of the product development, will also open up new growth path for the carbon fiber industry.

3. Improvement of industrial chain to promote synergistic development

At present, China has built up a complete industrial chain from carbon fiber raw silk, carbon fiber preparation to composite material application. The close cooperation and synergistic development of the upstream and downstream enterprises of the industry chain will significantly improve the production efficiency and product quality of carbon fiber. At the same time, the continuous improvement of the industry chain will also promote the carbon fiber in aerospace, new energy vehicles, sports equipment and other fields to be widely used, for the development of the industry to bring a broader market space.

(Ⅱ) Development trend

1. Accelerated capacity expansion

Globally, carbon fiber production capacity expansion trend is obvious. On the one hand, international giants are actively laying out, such as Toray of Japan, Hershey of the United States, and so on, continuously expanding the scale of production. On the other hand, domestic enterprises are also vigorously follow up, like Jilin Chemical Fiber, Jiangsu Hengshen, etc. have invested in the construction of new production lines. It is expected that by 2025, the global carbon fiber production capacity will be further enhanced, in which China occupies an important share, covering most of the new projects to meet the growing market demand.

2. Technological breakthroughs continue

Technology, low-cost manufacturing technology and high-performance product development are two key directions. Low-cost aspect, large tow raw silk technology and continuous carbonization process is gradually maturing, reduce production costs, enhance the cost-effectiveness of products. In the field of high performance, the research and development of high-modulus, high-strength carbon fiber products has made progress, to meet the aerospace, high-end equipment manufacturing and other fields of the stringent requirements of material performance. In addition, carbon fiber recycling technology has also become an industry hot spot to improve resource utilization and reduce environmental pollution.

3. Expansion of application fields

Carbon fiber application scenarios continue to expand, in addition to the traditional aerospace, wind power field, in new energy vehicles, rail transportation, sports equipment and other fields of application is also increasingly widespread. In new energy vehicles, it is used in battery shells and body structural parts to realize lightweight and improve range; in rail transportation, it is used in vehicle parts to reduce body weight and improve operational efficiency. With the rise of low-altitude economy and other emerging industries, the demand for carbon fiber in the field of unmanned aerial vehicles, eVTOL (electric vertical take-off and landing vehicles) and other areas will also grow rapidly.

Copyright © 2026 Zhangjiagang Weinuo Composites Co., Ltd. All rights reserved